Home Building Articles

New Home Sales Rise for the Third Straight Month, Prices Jump

Article by Lonny Coffey, Affiliated Bank Mortgage

The Commerce Department reported Wednesday that sales of new U.S.single-family homes rose for a third straight month in October.

Sales gained 0.7 percent to a seasonally adjusted annual rate of 458,000 units. Compared to October last year, sales were up 1.8 percent. New home sales, which account for about 8 percent of the housing market, tend to be volatile month to month.

The median new home price jumped 15.4 percent from a year ago to a record $305,000. Housing remains constrained by slow wage growth, which is resulting in a slow pace of household formation. Last month, new home sales rose 7.1 percent in the Northeast and surged 15.8 percent in the Midwest. In the populous South, sales fell 1.9 percent and were down 2.7 percent in the West. With sales rising modestly, the stock of new houses available on the market rose 1.0 percent last month to the highest level since June 2010.

At October's sales pace it would take 5.6 months to clear the supply of houses on the market, up from 5.5 months in September. Six months' supply is normally considered a healthy balance between supply and demand.

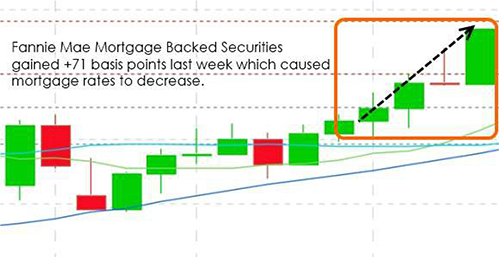

What Happened to Rates Last Week?

Mortgage backed securities (MBS) gained +71 basis points (BPS) from last Friday's close which caused 30 year fixed mortgage rates to move lower from the prior week. We had our best pricing on Friday and our worst pricing on Monday.

We had a very interesting holiday-shortened week with some more solid readings with our domestic economic data, but once again it was external factors that drove the long-bond market.

The GDP reading for the third quarter was revised upward from 3.5% to 3.9%. the rest of the economic data such as Chicago PMI, Consumer Confidence, Consumer Sentiment were are all lower than market expectations but were still at strong and expansionary levels. But bonds traded in a very narrow range until Thursday's OPEC decision.

The biggest catalyst for the improvement in MBS pricing was the fallout of the decision by OPEC to refrain from altering their output ceiling. The direct result is that oil fell (WTI $67.39).

In the short term, this very anti-inflationary...even deflationary. And bonds HATE inflation and growth. So, global deflation brought on by slow to no growth in Europe and now lower energy/input costs point the way for bonds to rally as our 10 year Treasury dropped. In addition to lower costs (anti-inflation) it slows our economic growth as energy companies in the U.S. will scale back hiring and capital investment as the price per barrel is cheaper than their costs to extract it.

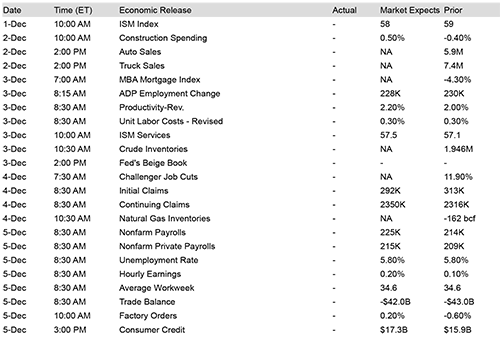

What to Watch Out For This Week:

The above are the major economic reports that will hit the market this week. They each have the ability to affect the pricing of Mortgage Backed Securities and therefore, interest rates for Government and Conventional mortgages. I will be watching these reports closely for you and let you know if there are any big surprises.

It is virtually impossible for you to keep track of what is going on with the economy and other events that can impact the housing and mortgage markets. Just leave it to me, I monitor the live trading of Mortgage Backed Securities which are the only thing government and conventional mortgage rates are based upon.